how much tax on death

Currently estates under 114 million are. After you calculate the taxable portion of the estate the applicable tax rates ranging from 18 to 40 are applied to the estate tax bracket the amount falls into.

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Tax-wise the new IRA recipient is subject to the same tax rules that any IRA holder would be.

. At the Federal level the tax rates exist on a sliding scale similar to income tax rates. If the deceased person is leaving a taxable estate you must file Form 1041. The deceased owners estate would owe estate taxes if the total value of all their assets combined with the value of the IRA or 401 k exceeds the federal or state estate tax exemption for that year.

Youll have to pay taxes on any distributions taken out of the account at current income tax rates. For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable. Notice that those percentages jump up pretty quickly.

Ontario Answer 189. However taxes may apply for insurance policies embedded in tax-advantaged plans. Federal exemption for deaths on or after January 1 2023.

Only a very small percentage of estates will be subjected to an estate or inheritance tax. First there are taxes on income or on capital gains earned during the last year of life. A death benefit is a payment triggered by the death of an insured individual.

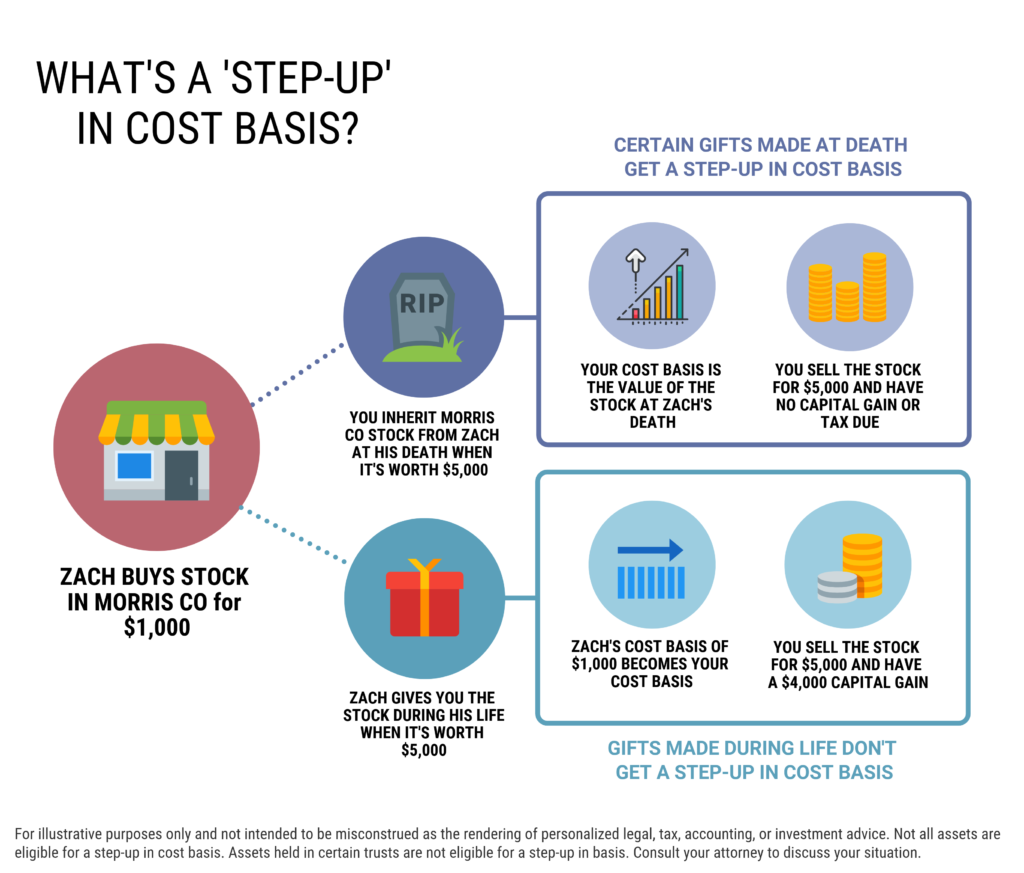

One approach is giving the money or property in question to its intended recipient while youre still alive. On the low end of the scale the rates are 18 for taxable amounts less than 10000. Pros and Cons of the Death Tax.

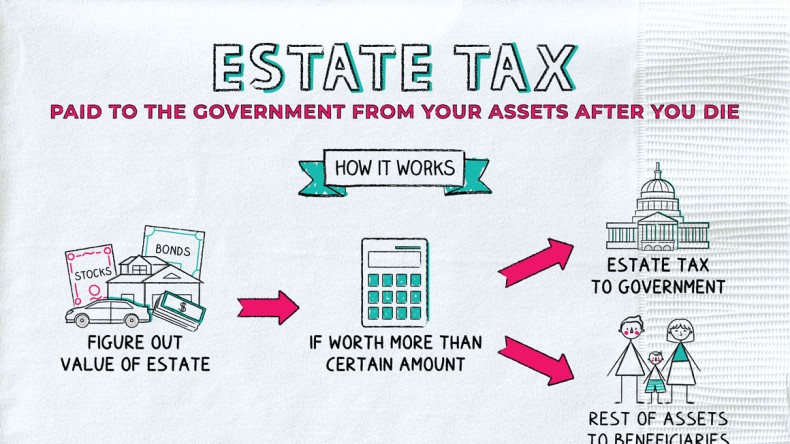

When the deceased person lived in. The federal estate tax sometimes called the death tax is a one-time tax that is imposed at death. The Estate Tax is a tax on your right to transfer property at your death.

EST Troy Davis was put to death by the state of Georgia after the US. Take a look at the chart one more time. Income Tax Return for Estates and Trusts.

Supreme Court failed to. Your estate is worth 500000 and your tax-free threshold is 325000. In some cases death benefits are completely tax-free for beneficiaries.

On September 21 2011 at exactly 1108 pm. Youll also need that form if the estates gross income was at least 600 during the tax year in question. For amounts over 1 million those funds will be taxed at a rate of 40.

These taxes are levied on the beneficiary that receives the property in the deceaseds will. 575 percent for the member and 075 percent for a surviving spouse pension. However more-distant family members like cousins get no exemption and pay an initial rate of 15.

The higher the value of the estate the higher the tax rate you will pay. That means that only families that have. For the 2021 tax year the federal estate tax exemption was 1170 million and In the 2022 tax year its 1206 million.

Death benefits are associated with life insurance policies. 675 for the member and 075 for a surviving spouse pension. While estate taxes seem to get all the publicity when it comes to taxes owed after someone dies the reality is that the majority of estates will not owe any federal estate taxes.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. Heres the good and bad. When you die 1206 million will be exempt from taxes.

Pros of death tax. If you take those distributions before you reach the age of 595 youll likely have to pay a 10 early withdrawal penalty fee to the IRS. The Administrator of the Estate or another representative of the deceased will need to report all income made during the year prior to their death and file the necessary deceased tax return.

Inheritance tax usually applies in two cases. Taxes imposed by the federal andor state government on someones estate upon their death. When family members try to prepare current tax returns for deceased individuals one of the most common.

Members who participate in the SLEP plan contribute 750 of salary on and after June 1 2006 toward a future SLEP pension. Before June 1 2006 SLEP members contributed 650 percent of salary. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Second there is interest or capital gains made on money in the estate. The federal estate tax exemption is 1206 million as of 2022 so this might not be a concern for most taxpayers.

For example if the taxable portion of the estate is 20000 then you would be taxed at 18 for the first 10000 and then 20 on the next 10000 adding up to 3800 in tax total. That means the federal government gets to collect 132 million in taxes leaving a total of 1368 million for your heirs. Although there is no death tax in Canada there are two main types of tax that are collected after someone dies.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. This entire sum is taxed at the federal estate tax rate which is currently 40. You can minimize the amount of taxes.

Of the remaining 20000 10000 will be taxed at 18 and 10000 will be taxed at 20 for a total tax bill of 3800. Youll receive a gift tax exemption of. As of tax year 2021 your gross assets need to exceed 117 million for you to be subject to the federal estate tax.

The Administrator will be responsible for gathering all of the deceased persons financial details though they can request previous tax transcripts.

What Is An Estate Tax Napkin Finance

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Its Tax Times Some Funny Tax Quotes That Will Tickle You Tax Quote Funny Dating Quotes Taxes Humor

Pin On Chicago Real Estate Attorney

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Much Will You Pay For Chicago S New Taxes Chicago Real Estate Chicago Estate Tax

Term Insurance Plans Offer Financial Security Asuransi

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

5 Excuses People Give For Not Buying Life Insurance Group Life Insurance Life Insurance Insurance

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

So Its Tax Season Again And We Here At Colbert Ball Katy Are Ready And Waiting To Get You Back Your Biggest Possible Refund Income Tax Tax Memes Taxes Humor

Dime Method For Insurance Stock Advisor Insurance First Love

Tips On Lowering Tax Liability Arising Out Of Profit Made By Selling A Property Sell Property Selling Real Estate Tax

Thruth Be Told Everything Funny True Life True Stories

/close-up-of-female-accountant-or-banker-making-calculations--savings--finances-and-economy-concept-1006671124-6a117470967b4b49960be0fb69f474a4.jpg)